Recently we reported that Netflix had a catastrophic earnings report. They were losing subscribers and blamed it partially on users sharing passwords. But they are also reported to be suffering from too much competition, and many think a lot of their shows have gotten too “woke” or have too much left-wing bias.

In our report, the stock had fallen 25% in after-hours trade. But it has fallen much more now, and continues to drop as the broader market drop from rising interest rates is proverbially kicking them while they’re down.

See our earlier story:

After the recent earnings report, it was said that Netflix was considering adding commercials to some of its products. It was a bad look for them in our view, as Netflix is seen as a premium product by many, and commercials may be an act of desperation. Nevertheless, it looks like based on a report, they will move forward with the plan.

This could go one of two ways, increase their income and help their falling stock price, or make users even angrier than they already are, causing another tumble in the market value of the company, triggering further decline that may be hard to stop.

ScreenCrush.com reported on New York Times story. SC reported in part that Netflix plans to introduce a cheaper tier with commercials by the end of this year. It is believed that this move may boost subscriptions and revenue. However, as we speculated, it could backfire as well in our view, and only time will tell.

Netflix is also planning on cracking down on password sharing, something they’ve been lax on in the past. It’s unclear how well that will go and how many people will get their own account after losing access due to the crackdown.

It’s clear that anything can happen and founder and co-CEO Reed Hastings is in uncharted territory. We also feel that many “woke” companies underestimate how many people boycott their products for this very reason, as has been acknowledged by the richest man in the world, Elon Musk.

Read more:

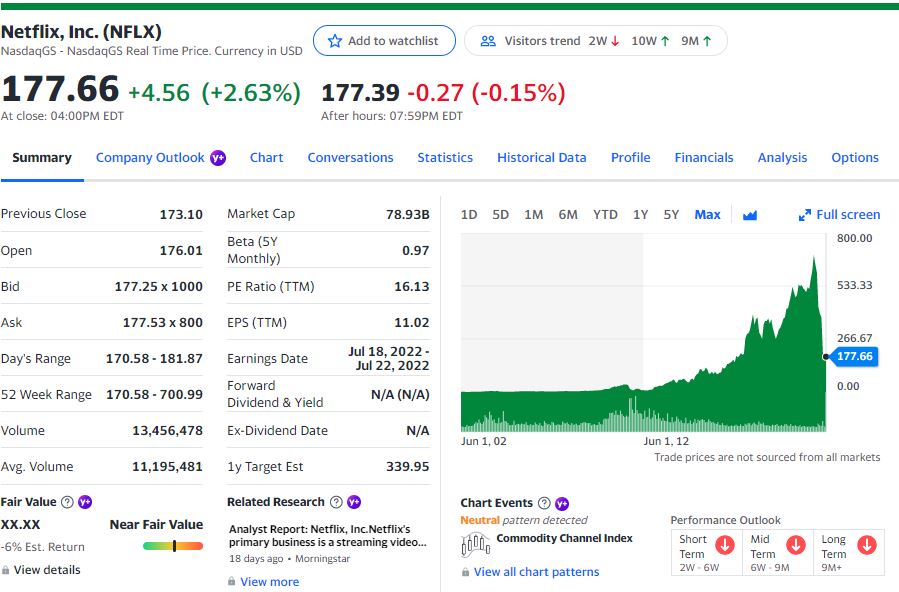

Below is a screenshot of Netflix stock’s closing price as of today, with the image linked to the current price sourced from Yahoo Finance. As you can see, the price is in the $170s from a high of around $700 earlier this year. This is a huge drop for a company that is in so many portfolios and index funds around the world, and many did not see this coming.

We are not financial advisors and anything stated regarding the said topic is opinion and speculation only. Please consult a financial advisor for advice about the stock market or investing.

- Trump Right Again, Despite the Doubters, Vindication Comes as MTG Joins the Banshees at The View - January 7, 2026

- Trump White House Posts Powerful Message to the World After Capture of Maduro, FAFO… - January 3, 2026

- Karoline Leavitt Expecting Second Child May 2026 - December 27, 2025