Joe Biden and the radical leftist Democrats recently touted a strong economic rebound and falling inflation rates. A Yahoo Finance report just highlighted how things may not be so rosy. While economic strength overall has remained stable, consumers are probably not doing as well as many may believe.

If Americans were as cash healthy as the Democrats would like you to think and even the Federal Reserve is behaving like, they may be paying down debts as well as doing lots of spending. But the New York Fed itself is actually reporting data that appears slightly more grim.

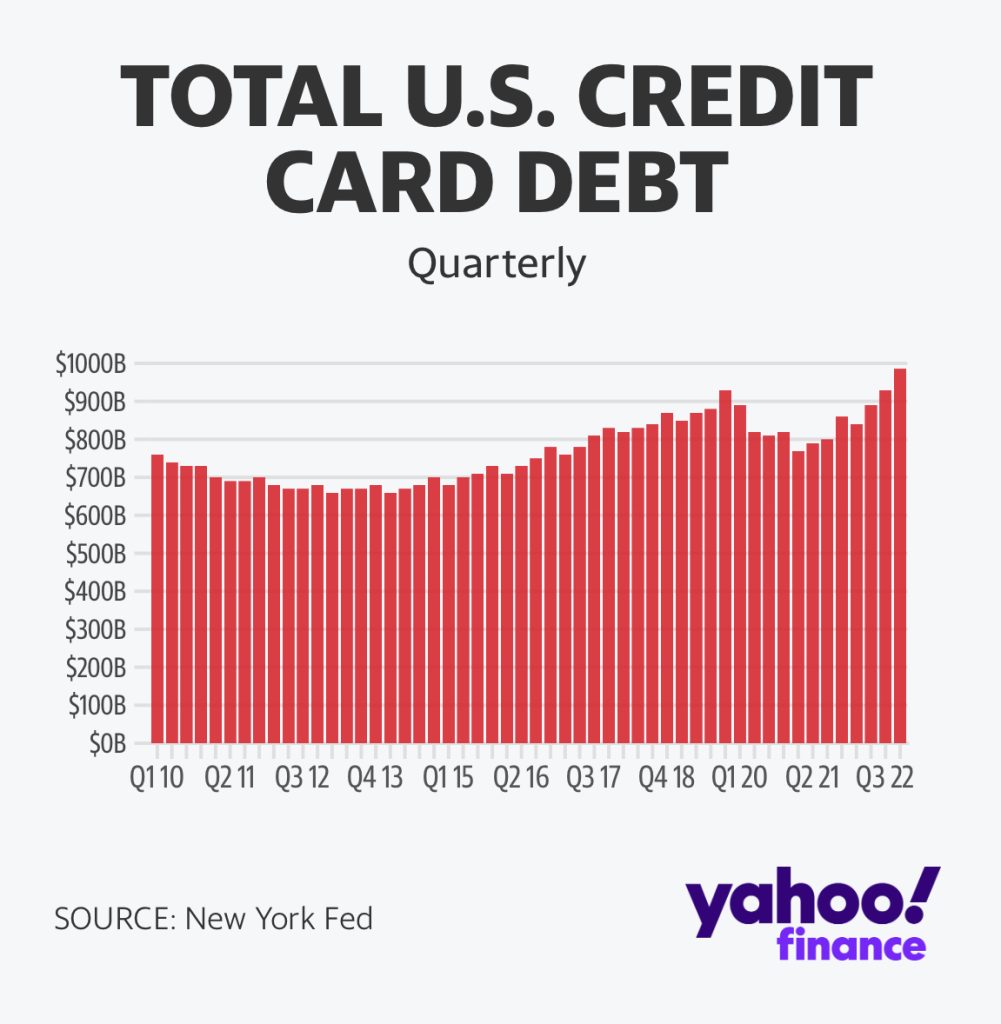

After falling slightly in 2020, credit card debt is now skyrocketing to new highs as inflation destroys the dollar’s value, despite some wage increases. U.S. consumer credit card debt is now nearing $1 trillion.

The report also highlights the rate of which credit card users are 90 days behind or more is also rising. This data is concerning as the fed tries to “fix” inflation with higher interest rates. We could be nearing an inflection point where something has to give.

Will rates have to spiral out of control to the point that consumers default on credit card and other forms of debt just to keep up with inflation while we are told we have a hot economy? We are not financial experts and only time will tell for sure.

However, with Democrats running the country for the most part, it seems they’re highlighting the rosy parts and not the scary parts of the current economic backdrop to keep their people elected, rather than finding true solutions to help Americans who may potentially be drowning in financial struggles under the guise of a recovering from Covid-19 economy.

Some who acknowledge this report at all may try to downplay it by mentioning that with inflation, the true debt may be lower than the dollar number, since everyone theoretically has more dollars.

While there may be some truth to that, more debt is never good and more inflation is also never good. If the two things keep going up, Biden may have some explaining to do when there is another potential recession on a horizon coming soon to you, in our speculation, although we hope not.

The stock market has recovered some from its lows recently, signaling a potential pause of rate increases by the Federal Reserve. But that being said, lower rates adds to the overspending causing inflation too, which could create a vicious cycle if Jerome Powell, the Chairman, has a crisis of identity between hawk and dove.

Many believe that less spending on foreign wars and more at home oil production in the U.S. would help. The Democrats and what many believe to be the “uniparty” believe we must continue funding foreign wars however, while global elites want to ban gasoline engine cars and get everyone into an expensive electric car, or worse, riding a bus or train instead.

Republicans running for president and congress in the next election cycle will probably say they can fix these problems. In our view though, both parties are in a race to spend more than the other to keep getting themselves elected.

Hard working middle class Americans by and large want a way to stop that cycle, but with an aging population relying on Medicaid and a lack of pro peace anti war candidates, it’s hard to see a major spending slowdown soon in government, much less a solution to the consumer credit card debt crisis.

The Yahoo Finance report also mentions student loan debt. Biden’s cash grab to cancel some of that, which was resisted by many of those who already paid for their college in full or who went to trace school, is on pause.

It may or may not happen pending court battles. Many consumers however, expecting that tiny windfall promised by Biden, may have budgeted for it and spent more already, which could be further strapping the U.S. consumer.

- Trump Right Again, Despite the Doubters, Vindication Comes as MTG Joins the Banshees at The View - January 7, 2026

- Trump White House Posts Powerful Message to the World After Capture of Maduro, FAFO… - January 3, 2026

- Karoline Leavitt Expecting Second Child May 2026 - December 27, 2025