When asked today about a proposed IRS bank account tracking plan that is in the $3.5 trillion reconciliation plan, House Speaker Nancy Pelosi lost patience with the reporter for daring to ask such a question.

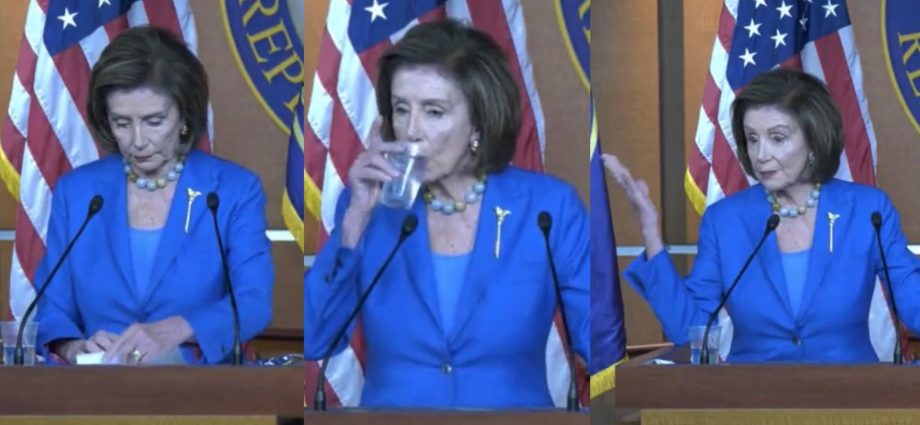

In a clip showing the interaction between Pelosi and the reporter, Pelosi can be seen sipping her water and nodding as the reporter attempts to ask the question before eventually cutting her off by saying “Yes” five times.

The reporter told Pelosi that banks have been getting calls about the tracking of transactions greater than $600 and that Americans are “starting to worry about this.”

“Do you think that this… giving the irs more money to crack down on unpaid taxes is going to stay in the IRS bill and what do you say to Americans worried about that?” the reporter asked.

Pelosi responded, “With all due respect, the plural of anecdote is not data I’ve said that before there. Yes, there are concerns that some people have but if people are breaking the law and not paying their taxes, one way to track them is through the banking measure.”

“I think 600… well that’s a negotiation that will go on as to what the amount is, but yes,” Pelosi reaffirmed.

Pelosi confirms Democrats plan to use IRS to track bank accounts with as little as $600 in deposits and withdrawals pic.twitter.com/7rU45LGRMB

— Mike Berg (@MikeKBerg) October 12, 2021

Factcheck.org recently did a fact check on the situation, making it tough for non-mainstream news outlets now to really discuss the proposal in detail and not have to worry about being fact checked.

The title of the fact check was “Republicans Mischaracterize Proposed Financial Reporting Requirement.”

In the fact check, they claimed that Senate Minority Leader Mitch McConnell, U.S. Sen John Barrasso (R-WY), U.S. Sen Tim Scott (R-SC), and House Minority Leader Kevin McCarthy (R-CA) all mischaracterized the proposal.

They quoted Treasury Secretary Janet Yellen as having said of the proposal, “We’re simply asking to add two boxes to that [IRS 1099-INT] form, one that would be the aggregate inflows into the account over the course of the year, and the second would be the aggregate outflows from the accounts. So it’s not detailed information.”

So ultimately, we are supposed to take her word that they are simply attempting to monitor if a profit was made through a bank account.

Even if that is the case, according to Steven Rosenthal, a senior fellow with the Urban-Brookings Tax Policy Center, it is going to be tough to discern what is what.

“The Biden administration believes that aggregate information [for annual deposits and withdrawals] will help the IRS find tax cheats. I’m skeptical. I don’t think it will. And one of the reasons I don’t think it will is because it’s not transaction by transaction. It’s just an aggregate amount and it bears no relationship to income tax liability,” Rosenthal explained.

- Tim Kaine Provides Cover For Joe Biden on the Border Crisis, Blames Lack of a ‘Robust Work Visa Program’ for ‘Some of the Chaos at the Border’ - March 27, 2024

- Elon Musk Rips NBC For Hiring and ‘Immediately’ Firing Ronna McDaniel ‘That’s How Biased They Are!’ - March 27, 2024

- Marjorie Taylor Greene Makes Move, Files Motion to Vacate Against Speaker Mike Johnson After House Passage of $1.2T Spending Bill - March 22, 2024