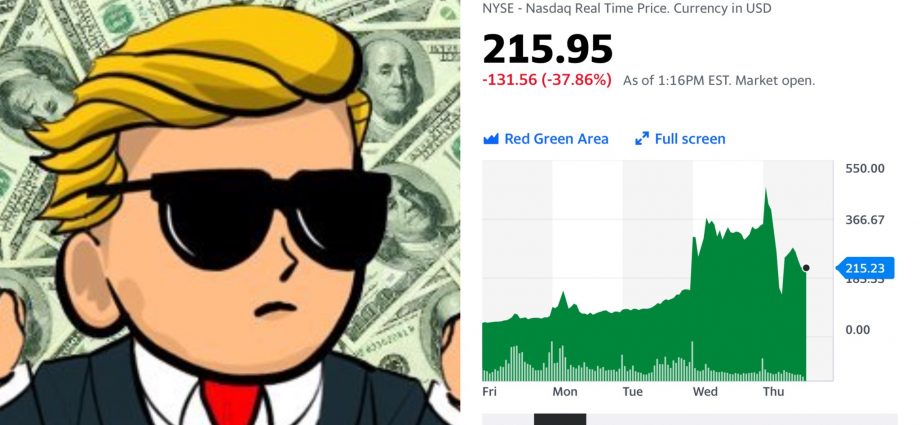

The last few days have seen some wacky and unconventional trading moves in the U.S. stock markets. Redditors in a group called Wall Street Bets and probably other traders have banded together to buy many stocks that are shorted by hedge funds. This means the more people buy GameStop and other stocks like it, the more these hedge funds lose money.

As you can read here, Citadel buys the Robinhood order flow which according to CNBC is why trades are free on Robinhood. We don’t have the ability to say for sure if there is illegal activity going on but it all seems very fishy to us and time will well.

Melvin Capital is one hedge fund that was at one point heavily shorting GameStop stock. Citadel Securities LLC is another firm, that was reported to have bailed them out with about $3 Billion dollars. Now Robinhood, one of the major brokerages where many of the traders of Gamestop and others have been making their moves, has blocked the trading of GameStop.

In light of current market volatility, we are restricting transactions for certain securities to position closing only, including $AMC and $GME. Read more here.https://t.co/CdJMjGAeFH

— Robinhood (@RobinhoodApp) January 28, 2021

Hedge funds have reportedly lost billions on their short sales over the last few days and many are claiming they are not playing by the rules to fight back against retail investors.

We have discovered that Robinhood has a major relationship with Citadel, making it all look very fishy. According to some tweets on Twitter, some lawsuits are already being prepared and the fury from traders has just begun.

BREAKING: Class action complaint against @RobinhoodApp filed in the southern district of NYhttps://t.co/DuGP3LIQDQ pic.twitter.com/mw82RRoA2L

— Lydia Moynihan (@LJMoynihan) January 28, 2021

Ironically enough, U.S. Senator Ted Cruz (R-TX) has actually agreed with U.S. House Rep Alexandria Ocasio Cortez (D-NY) that something is very wrong with the disallowing of traders to trade certain stocks by Robinhood and some other brokerages:

Ted says he agrees when AOC tweeted:

“This is unacceptable. We now need to know more about @RobinhoodApp’s decision to block retail investors from purchasing stock while hedge funds are freely able to trade the stock as they see fit. As a member of the Financial Services Cmte, I’d support a hearing if necessary.”

See tweet:

Fully agree.

— Ted Cruz (@tedcruz) January 28, 2021https://t.co/rW38zfLYGh

We do not offer investment advice and you should always seek your financial advisor’s opinion before making any investments. Stay tuned for updates on this wild situation.

UPDATE: We can’t confirm if this is true but they are wild accusation if they are:

Justin Kan tweeted:

“Just got a tip that Citadel reloaded their shorts before they told Robinhood to stop trading $GME. If this is true, Ken Griffin and the Robinhood founders should be in jail. This is class warfare.”

Just got a tip that Citadel reloaded their shorts before they told Robinhood to stop trading $GME.

— Justin Kan (@justinkan) January 28, 2021

If this is true, Ken Griffin and the Robinhood founders should be in jail.

This is class warfare.

- Alleged ‘Christian’ University in Idaho Busted by Senator with LGBT and Pro Transgender Books Prominently Displayed on Campus - June 7, 2025

- Joe Biden Diagnosed with Aggressive form of Prostate Cancer - May 18, 2025

- Report: Kash Patel is Directing Secret Service to Investigate James Comey as he Removes Instagram Post and Claims he Didn’t Know What it Meant - May 15, 2025

4 Comments